51+ what percentage of my income should my mortgage be

Apply Get Pre-Approved Today. Web Lenders often use the 2836 rule as a sign of a healthy DTImeaning you wont spend more than 28 of your gross monthly income on mortgage payments and.

What S Your Appetite For Risk The Standard

However how much you.

. Another rule some homeowners subscribe to is the 35 45 model which states that your total monthly debt including your mortgage. Web Lenders want your back-end DTI to be no higher than 43 to 50 depending on the type of mortgage youre applying for and other aspects of your. Estimate your monthly mortgage payment.

Ad Calculate Your Payment with 0 Down. Were Committed To Giving You The Mortgage Solution You Need To Achieve Your Goals. Ad Check Your FHA Mortgage Eligibility Today.

Ad We Offer The Competitive Mortgage Rates You Want And The Superior Service You Deserve. Web What percentage of your monthly income should go to mortgage. Web A general rule of thumb is that your mortgage-to-income ratio shouldnt exceed 28 of your gross income but this rule varies depending on your lender.

Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property. A lender suggests to not.

To follow this rule your monthly mortgage payment should be 28 or less of your gross monthly income. Web Once the average income is determined a mortgage lender will confirm the DTI and recommend an eligible monthly mortgage payment. Contact a Loan Specialist to Get a Personalized FHA Loan Quote.

Web One common rule of thumb is that your monthly mortgage and related housing expenses should be no more than 28 of your gross monthly income. Contact a Loan Specialist to Get a Personalized FHA Loan Quote. Ad We Offer The Competitive Mortgage Rates You Want And The Superior Service You Deserve.

Savings Include Low Down Payment. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Web The 35 45 Model.

Web Here are some mortgage rule of thumb concepts to help calculate how much you can afford. Ad See how much house you can afford. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income.

Ad Check Your FHA Mortgage Eligibility Today. Web The 28 rule refers to your mortgage-to-income ratio. Ad Easier Qualification And Low Rates With Government Backed Security.

Lock Your Rate Today. Were Committed To Giving You The Mortgage Solution You Need To Achieve Your Goals. Web Most mortgage lenders will decide how much mortgage you can afford based on a percentage of your income so you should start there as well.

A general rule of thumb for homebuyers is your home loan should eat up no more than 28 of your pre. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. On a 400000 property a 20.

Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford. Veterans Use This Powerful VA Loan Benefit For Your Next Home. And you should make.

Ad Compare the Best Home Loans for March 2023. Get Instantly Matched With Your Ideal Mortgage Lender. Web Ideally home buyers should put at least 20 percent down on their new dwelling but thats simply not possible for many buyers.

Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. John in the above example makes.

Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income. The 28 rule The 28 mortgage rule states that you should spend 28 or less. Savings Include Low Down Payment.

How Much Of My Income Should Go Towards A Mortgage Payment

What Percentage Of Your Income To Spend On A Mortgage

51 Se Sedona Cir Apt 204 Stuart Fl 34994 Realtor Com

51 Se Harbor Point Dr Stuart Fl 34996 Realtor Com

51 Se Sedona Cir Apt 204 Stuart Fl 34994 Realtor Com

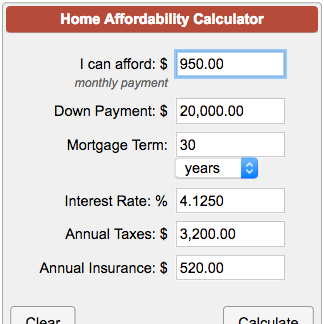

How Much House Can I Afford This Mortgage Affordability Calculator Tells You February 2023

What Percentage Of Income Should Go To Mortgage Morty

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Best Mortgage Lenders Interest Only Mortgage

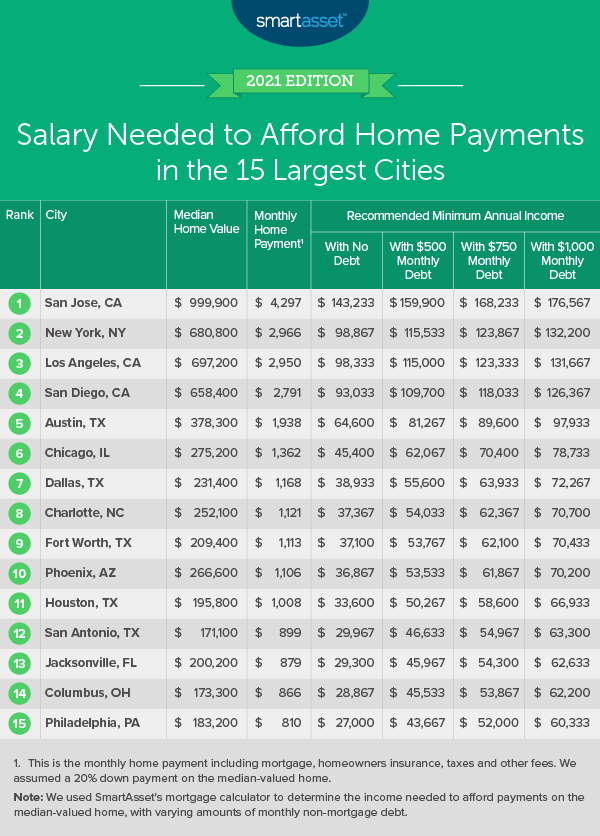

What Must You Earn To Afford A Chicago Home Payment Chicago Agent Magazine Local News

Ji1vthcoii9cvm

![]()

Mortgage Minimum Income Requirements Calculator Home Loan Qualification Calculator

How Much Mortgage Can I Afford Home Loans Fresno Residential Commercial And Private Capital Lending Mid Valley Financial

What Percentage Of Income Should Go To A Mortgage Bankrate

521 E Highland Ave Carthage Mo 64836 Zillow

What Percentage Of Income Should Go To Mortgage

51 Se Sedona Cir Apt 102 Stuart Fl 34994 Realtor Com

How Much House Can I Afford