Asset allocation calculator excel

Over 90 percent of investment returns are determined by how investors allocate their assets versus security selection market timing and other factors Use this calculator to help. This tool will suggest an asset allocation for you across different asset classes based on your level of risk capacity and risk tolerance.

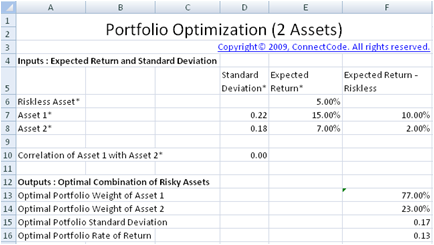

Free Portfolio Optimization

Use the asset allocation worksheet to calculate your current asset class weightings in non-farm investments.

. Do you know that mid and small caps generate better return in logn term. The quick way to calculate your bond allocation. The financial planning software modules for sale are on the right-side column This investment software is not sold.

Creating an emergency fund kept in bank accounts and highly liquid. The risk-based asset allocation also includes a risk attribution analysis showing the contribution of each asset to overall portfolio risk. The Asset Allocation Calculator is designed to help create a balanced portfolio of investments.

Asset Allocation Calculator - Financial Tool. For each fund multiply the percentage that the fund represents in your portfolio by the percentage of the fund thats. Over 90 percent of investment returns are determined by how investors allocate their assets versus security selection market timing and other factors Use this calculator to help.

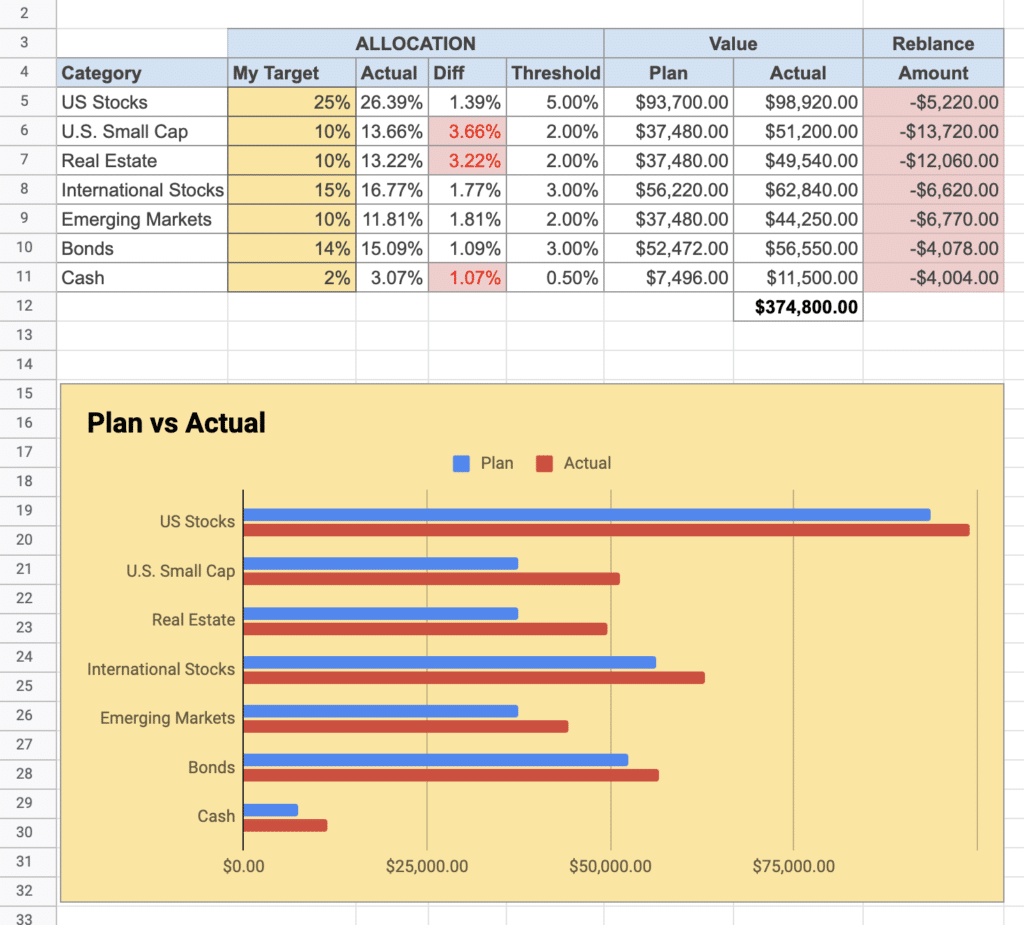

Overall Asset Allocation This column shows the allocation to each asset class after the adjustment. Determining the amount of investable assets. Asset Allocation Calculator Asset Allocation Tool helps investment in Asset Allocation Fund and decide Asset Allocation Startegies.

How should I allocate my. Simply replace the letters in the row placeholders with a description of your. These comparative schedules clearly highlight the key.

Easy Simple Quick and Dirty Asset Allocation Calculator. Use the information on your investment Excel template to plan your investment strategies. After determining your asset allocation target use the information on the spreadsheet to compare.

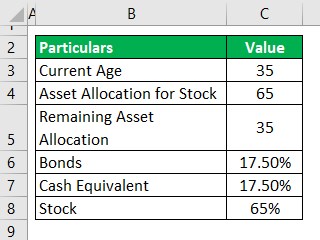

Your age ability to tolerate risk and several other factors are used to. The asset allocation is designed to help you create a balanced portfolio of investments. Age ability to tolerate risk and several other factors are used to calculate a desirable mix of.

This allows you to easily track the effect on your allocation of adding 10000 to a balanced fund. Your current Age Years 46-60 yrs. The sequence of the allocation process included in the model.

Tfbs article Cascading Asset Allocation Method. Notice that the total amount required to accomplish the rebalancing for the entire.

Excel Portfolio Management Building The Worksheet Financetrainingcourse Com

Portfolio Optimizer For Excel Hoadley

The Best Free Asset Allocation Spreadsheet Valuist

Rebalancing Your Portfolio With An Asset Allocation Spreadsheet

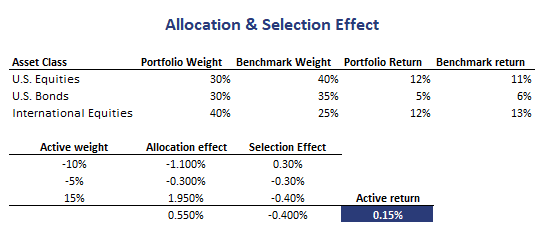

Allocation Effect Implementation In Excel

A Spreadsheet For Tracking Your Investment Portfolio Total Market Value Asset Allocation Investment Performance Re Balancing R Personalfinancecanada

Portfolio Analysis Excel

Portfolio Optimization Seven Security Example With Excel Solver Youtube

Here Is The Most Easy To Use Portfolio Rebalance Tool Portfolio Einstein

Asset Allocation Calculator Allocate The Assets Using Thumb Rule

Asset Allocation Spreadsheet Excel Template White Coat Investor

The Best Free Asset Allocation Spreadsheet Valuist

The Ultimate Investment Tracking Spreadsheet Just Updated

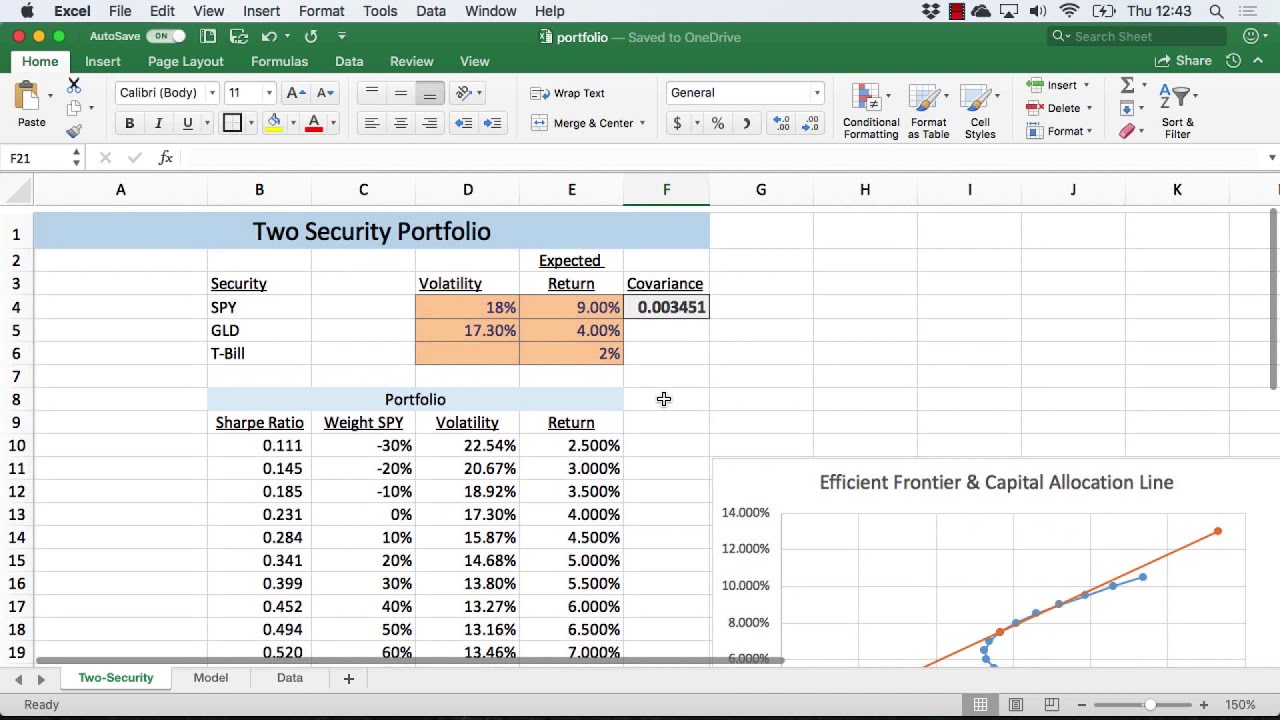

Calculating A Sharpe Optimal Portfolio With Excel

Excel Portfolio Management Building The Worksheet Financetrainingcourse Com

Asset Allocation Spreadsheet Excel Template White Coat Investor

An Awesome And Free Investment Tracking Spreadsheet The Dough Roller